- Dapatkan link

- Aplikasi Lainnya

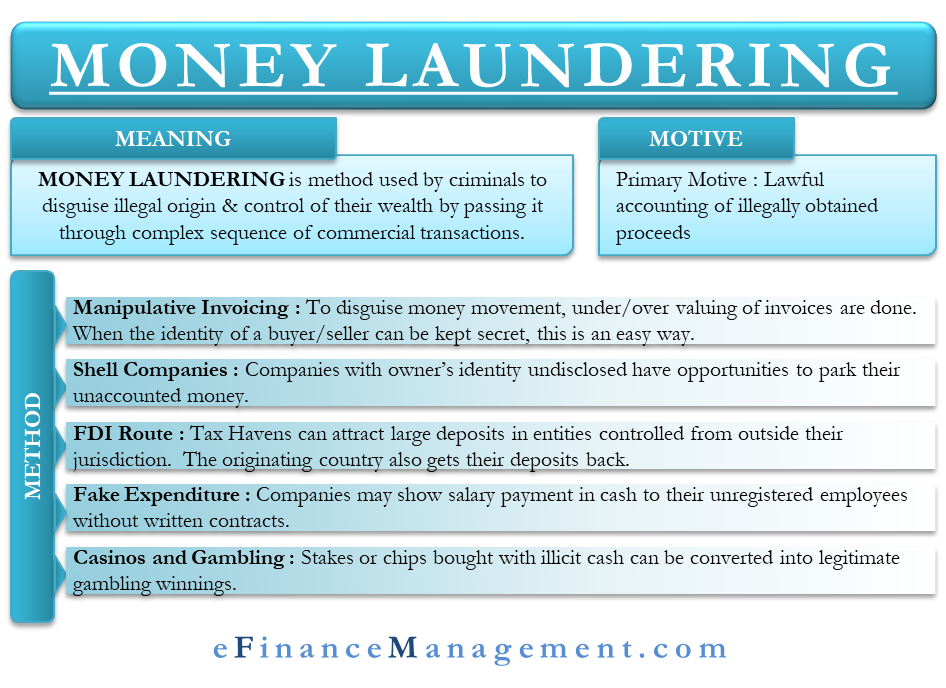

The idea of cash laundering is very important to be understood for these working in the monetary sector. It is a course of by which soiled cash is converted into clear money. The sources of the cash in actual are prison and the cash is invested in a method that makes it appear like clean money and hide the identity of the legal a part of the cash earned.

While executing the monetary transactions and establishing relationship with the brand new clients or sustaining present prospects the duty of adopting sufficient measures lie on each one who is part of the organization. The identification of such ingredient at first is easy to take care of as an alternative realizing and encountering such conditions later on in the transaction stage. The central financial institution in any nation gives full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide enough security to the banks to deter such situations.

The basic money laundering methods involve black market foreign exchange offshore banking business investments in fake or legitimate companies and smurfing. Money laundering is a means of storing or transporting money while obscuring its true origin.

First Stage Of Money Laundering Placement People Launder Money Using Money Laundering Techniques For Two Principal Reasons

Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often spread out over many different.

Different types of money laundering techniques. While you might be aware of some of the more common money laundering techniques such as large smurfing invoicing through shell companies and transfers to offshore accounts there. A classic money laundering example this involves physically smuggling banknotes to another. Money laundering disguises the illegal origin and legitimizes the funds so they can be openly.

Criminals often find one way or the other to do the illegal things there are some of the common ways which they use to launder money into the legitimate financial system. There are several ways to do this. They recognize this and understand at the same time that the owner needs some.

Bank tellers are trained to be aware of large deposits and withdrawals and to look for signs these may be a part of a larger. The crime of money laundering has long been used to hide the money of illegal activities within relatively lawful funds. Money Laundering is the process of changing the colors of the money.

To know more about it read the following points given below. Money laundering is a way for criminals to hide the cash proceeds of their illegal schemes. While land-based casinos are known to be used in the placement stage of money laundering in which currency is introduced into the financial system Internet gambling is particularly well-suited for the laying and integration stages of money laundering in which launderers attempt to disguise the nature or ownership of the proceeds by concealing or blending transactions within the mass of apparently.

Also referred to as structuring it can be seen that this particular technique involves breaking significant sums of money into smaller chunks or multiple deposits. Also called smurfing it is a method of placement whereby money is broken into smaller deposits. Money laundering the process of making crime proceeds legitimate is continuing with its all three steps.

These costs include fines imprisonment and reputation damage. Placement This is the movement of cash from its source. They include using shell companies small bank deposits and regular consistent bank deposits.

This can also be spread across various different accounts in order to avoid the risk of detection. Four methods of money launderingcash smuggling casinos and other gambling venues insurance policies and securitiesare described below in. Reselling high-value goods such as artwork or any type of stored-value product such as jewelry or prepaid cards.

Making the money legit to use freely. Smurfing is one money laundering technique that is used in order to launder money. Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets.

Investing in other legitimate business interests. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by. Methods and Stages of Money Laundering There are three stages involved in money laundering.

Money Laundering is an act of act of disguising the illegal source of income. Placement layering and integration. A non-exhaustive list of supervised learning techniques includes gradient boosting and its adaptations random forests and neural networks.

What is money laundering. Different types of money laundering techniques. The MoneyLaundering Process.

Placing layering and integration. Its very easy to define but involves multiple techniques. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration.

The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across borders. These techniques are powerful and are designed due to their inherent high-dimensionality to have the ability to fit in-sample with a great degree of accuracy. When money is obtained from various illegal activities such as corruption bribery tax evasion drugs where the criminal does not want the authorities to know the source of the income they engage in money laundering.

Money Laundering Methods Structuring. Investing in real estate. There lots of techniques try this and the more sophisticated the technique generally the more sophisticated the criminal is behind it.

Financial crimes unit and anti-money laundering AML investigators know that inherent in money-laundering techniques is the requisite that the owner and origin of the funds be hidden. Smuggling cash to other.

Money Laundering Ring Around The White Collar

Money Laundering Methods In The Megaserver Case Download Scientific Diagram

What Is Money Laundering Three Methods Or Stages In Money Laundering

An Introduction To Aml Part 2 Methods Of Money Laundering Planet Compliance

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

How Money Laundering Works Howstuffworks

What Are Some Largely Used Money Laundering Methods Tookitaki Tookitaki

Money Laundering Overview How It Works Example

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

Money Laundering Define Motive Methods Danger Magnitude Control

Cryptocurrency Money Laundering Explained Bitquery

Financial Action Task Force On Money Laundering Fatf Fincen Gov

The world of rules can look like a bowl of alphabet soup at occasions. US money laundering regulations aren't any exception. We have now compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Risk is consulting firm focused on protecting monetary companies by reducing threat, fraud and losses. We have now large financial institution experience in operational and regulatory danger. We have a robust background in program management, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many hostile penalties to the group due to the risks it presents. It increases the probability of main dangers and the opportunity cost of the bank and in the end causes the financial institution to face losses.

- Dapatkan link

- Aplikasi Lainnya

Komentar

Posting Komentar